unrealized capital gains tax janet

276k members in the Accounting community. An UNREALIZED GAIN is one in which the underlying asset is not sold but simply valued comparing the price from last year to the price this year even though you have not.

High Class Problem Large Realized Capital Gains Montag Wealth

Unrealized losses occur when an investment you hold has lost money but you dont.

. Apparently Janet Yellen has been floating the idea of an unrealized capital gains tax. The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. 36 votes 105 comments.

The fact Janet Yellen is even considering an unrealized capital gains tax perfectly illustrates the monstrous economic crisis were in. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. Primarily for accountants and aspiring accountants to learn about and discuss.

Itll work the same way cap gains do now. Capital gains tax is a tax on the profit that investors realise. Not exactly sure how that would work especially if the next year the stock price drops below what you paid for.

As Cathie Wood states it is the worst proposal of all when it comes to stock market investing. Treasury Secretary Janet Yellen announced on October 23 that a proposed tax on unrealized capital gains yes gains from investments that havent. Treasury Secretary nominee Janet Yellen reportedly said she would consider taxing unrealized capital gains but billionaire investor Howard Marks said its not a practical.

An unrealized capital gains tax would change the stock market forever. It doesnt take a genius to realize how stupid this is and how difficult it would be to actually. Fully tax capital gains but limit deductions to 4000 when capital assets.

They are willing to annihilate all investor. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealised capital gains. Janet Yellen doesnt care.

Lawmakers are considering taxing unrealized capital gains. If you dont sell the asset you have an unrealized capital gain which isnt subject to taxes. The unsold wealth of the super rich are often transferred.

Janet Yellen proposes taxes on unrealized capital gains while Biden continues to push for 87000 new IRS workers. And then theyll be taxing unrealized gains in wealth taxes. October 24 2021 1056 PM.

US Treasury Secretary Janet Yellen has proposed a tax on unrealised capital gains of billionaires. It looks like Janet Yellen would like to tax unrealized capital gains. Inflation continues to rise as the Biden social spending plan.

Mr Whale Cryptowhale Us Treasury Secretary Janet Yellen Suggests Imposing A Tax On Unrealized Capital Gains

Oaktree S Howard Marks On Unrealized Capital Gains Tax Janet Yellen

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

Discover Unrealized Capital Gains S Popular Videos Tiktok

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

Build Back Better Legislation Tax On Unrealized Capital Gains Does Not Pass The Fairness Test Ethics Sage

The Democrats Wealth Tax Mirage Wsj

Therapist Are The Unrealized Capital Gains In The Room With Us Now Janet R Bitcoin

Despite Yellen S Denials Democrats Are Pushing A Wealth Tax Orange County Register

Janet Yellen May Give Us Bitcoin Investors Tax Shock Somag News

Democrats Proposed Tax On Unrealized Capital Gains Likely Unconstitutional The Heritage Foundation

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains Taxes Bitcoin News

Democrats Billionaires Tax What Is Is And How It Would Work

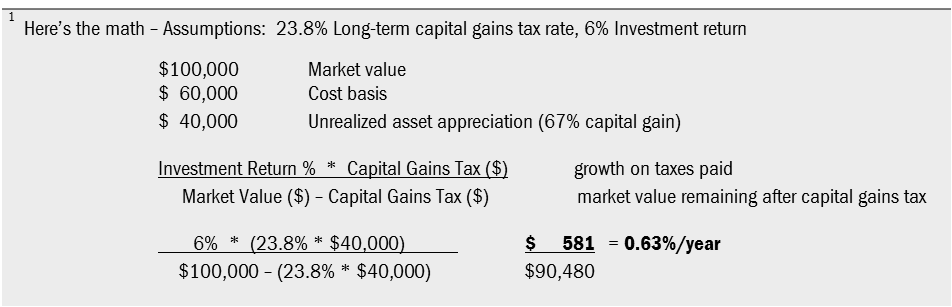

Taxing Unrealized Capital Gains Veristrat Llc What S It Worth

Tax On Unrealized Capital Gains Proposal By Janet Yellen Exponential Age Youtube

Being Libertarian Janet Yellen Kv Facebook

Here S How Janet Yellen S Proposed Tax On Unrealised Capital Gains May Work Business Insider India

Here S How To Win Democrats Vow To Tax The Rich Salon Com

Why Congress Shouldn T Rush To Enact Poorly Conceived New Taxes To Fund Spending Spree The Heritage Foundation